AMC Entertainment: Another CEO Doesn’t Understand Short Selling (NYSE:AMC)

7 min read [ad_1]

J. Michael Jones

I had to cringe when Elon Musk called out Bill Gates and other short sellers.

Today we hear that AMC Entertainment Holdings, Inc.’s (NYSE:AMC) CEO Adam Aron has done the same. In this article, I will discuss the simple reality of short selling and the outlook for AMC in Q2 earnings.

AMC Entertainment’s CEO has talked of a ‘pounce’ on short sellers

As Seeking Alpha reported, AMC Entertainment stock jumped 13% after the CEO discussed a potential pounce on short sellers.

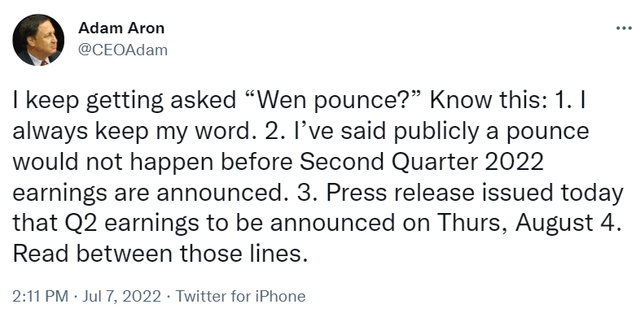

Adam Aron had said the following in a tweet:

Adam Aron (Twitter)

His tweet is in reference to the last earnings call for AMC Entertainment where he made further remarks on short selling.

“Your ire and anger directed at short sellers is evident. I hear your suggestions that we should call for more market regulation by government or that we should take more company action by issuing a cash, gift card or NFT dividend,” Aron said.

Short sellers can’t hold down a winning stock

If any company’s CEO should know about the dangers that short selling entails, it is AMC Entertainment. In 2021, the stock rocketed from lows of around $2.00 to a high of around $71.00 before crashing back down to its current price of $14.50. AMC Entertainment had a huge short interest at the time that was more than the stock available to buy, highlighting leveraged shorts.

If we look at that move and the resulting price collapse then Aron’s comments are ridiculous. AMC destroyed short sellers and hedge funds in 2021 and cleared the huge blocks of shorts, and what happened?

The stock has run out of steam as the meme investor crowd ran out of money and the stock has dropped back to reality based on its underlying financials. Now that the company has seen its stock tumble again, are we to believe the CEO that the only thing holding back the company stock is an unruly bunch of shorts?

His comments are the same as Tesla (TSLA) founder Elon Musk, who has called out two prominent investors over their short positions in his company. The outspoken entrepreneur singled out Michael Burry and Bill Gates for going against his company with short positions.

Elon Musk should also know that short positions have little bearing on the long-term valuation of a stock, especially in one of the market’s most popular names. If the business continues to grow and maybe provides new products, or improves others, the company would blast higher and hurt short positions. The ensuing buying pressure then adds to the level that shorts can exit, which exacerbates the short squeeze.

Making it even worse for Elon Musk is that he admitted in May 2020 that his company’s stock was overvalued at $150. The company went on to trade at highs above $1,200 and, despite the recent tech wreck, they are still around $750.

The problem with these CEOs is that they cannot admit their own influence on the lower stock prices and declining sentiment in the company. For Tesla, it was based on delays to the Cybertruck which had already been priced into the stock. The company’s valuation had also charged ahead to eye-watering levels at the peak of the free money, zero percent interest rate party. For AMC, the stock should never have traded as high as the $70 mark. That was pure speculation, and CEOs never complain or call for government regulation when valuations are skewed to the upside.

The reality is that taking a short position on a stock is as dangerous as trying to catch a bottom. It is about price finding and if companies can provide real value creation, they can blow out short positions. In the same way that more bad news can hurt a bottom fisher.

The AMC Entertainment picture, then and now

In AMC Entertainment, the current short float is only 20%, which is a far cry from the 125% percent that we saw back in early 2021.

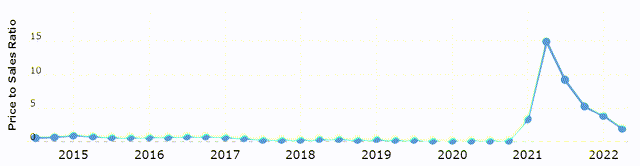

AMC P/S Ratio (Macro Trends)

In AMC stock, we can see that the price-to-sales ratio rallied in a matter of months from 0.18x to 14.92x based on no increased sales. At the time this was a company with revenues driven by a bricks-and-mortar cinema model. At the time, cinemas had been locked down and the company was struggling with debt.

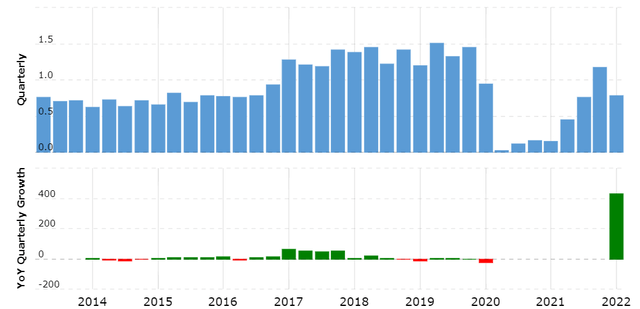

AMC Revenues (Macro Trends)

If we look at the revenue picture in 2020, anyone expecting this company to drive higher than 15x sales with near-zero revenues was denying the reality of the recovery task needed at AMC. Revenues have now recovered but are not close to their previous levels before the pandemic.

So, the reality in the present moment is that AMC Entertainment is now trading at 2x sales, and based on the revenue trend, that is not really a punishment.

The comments from Adam Aron are also disappointing because the CEO seems desperate to appeal to the Reddit “ape” gamblers and even references their slang with his “wen pounce” comment. If the company could produce something tangible then it would not have to rely on gimmicks and a short squeeze. Even if they do blow shorts away, the market will eventually find the correct valuation as it did last time.

His further comment that the company should, “issue a cash, gift card or NFT dividend.,” shows that the company has lost its way with the traditional business model. Although it may be able to release a short-term income burst from an NFT range, where is the long-term value for investors in this stock?

The outlook for Q2 earnings in AMC Entertainment

As we look ahead to the Q2 earnings in AMC Entertainment, the company’s CEO made an interesting point.

In his tweet this week about short sellers, Aron said:

“I’ve said publicly a pounce would not happen before Second Quarter 2022 earnings are announced… Press release issued today that Q2 earnings to be announced on Thurs, August 4. Read between those lines.”

His tweet obviously implies that the company may have purchased some new stock and that the Q2 earnings report could provide the fuel for the short squeeze.

In the Q1 earnings report, AMC Entertainment announced that revenues grew to $785.7 million compared to $148.3 million for the first quarter of 2021.

That is a strong performance, but we are talking about the lockdowns again and the company has no plan for growth beyond the cinema recovery. The purchase of distressed cinema locations really just drags the company back to its pre-pandemic problems, with the streaming versus physical war set to continue. Despite those profits in Q1, the company announced a net loss of 337.4 million compared to a net loss of $567.2 million for the first quarter of 2021. Again, we see nothing that has changed for AMC when we look at longer-term trends.

The opening statement by Aron made the reality clear:

“Our results for the first quarter of 2022 represent AMC’s strongest first quarter in two full years. We continue on our pandemic recovery trajectory, more than quintupling revenues and improving adjusted EBITDA by nearly eighty percent compared to a year ago. The significant progress AMC has made is very rewarding, as our guests continue to recognize the unparalleled movie-going experience offered by AMC.”

The Reddit Apes are deep in a stock that they bought at inflated, speculative highs and in denial that they own a cinema pandemic recovery stock.

The Q1 earnings also failed to note that the company is running a negative free cash flow. The CEO said that the strategy was to: guard our strong liquidity position, strengthen our balance sheet, innovate with our marketing programs to drive revenue, contain costs, invest in our core business and continue to explore transformative value-creating investment opportunities.”

So, the company has a strong cash-in-hand balance of $1.16 billion, but that is not large in comparison to the losses in earnings, and the negative cash flow. If the company wants to make “value-creating” opportunities then it looks like a cryptocurrency gimmick is the best we can hope for.

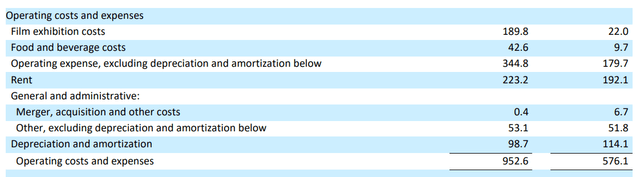

AMC Q1 Financials (AMC Investor Relations)

Just as the revenues increased from cinema re-openings, we can see that expenses increased also, with film exhibition costs, rents, and general expenses soaking up the bulk of sales. The FCF position will not be improving anytime soon and the company shouldn’t expect a pass on its valuation. The Q2 results will likely get the company closer to its pre-pandemic levels, and also see the company closer to free cash flow.

Conclusion

I hate to see CEOs calling out short sellers for underperformance in their stock prices. If there are two companies that should not complain about valuations, then it is Tesla and AMC Entertainment. AMC and its CEO are clinging to 2021’s performance, which was the perfect storm of a price bottom and speculative mania which squeezed shorts. Even if the company tries to squeeze short positions again, which are much lower this time around, the reality is that this is a loss-making, cinema turnaround stock and the market will eventually catch up on valuation again.

Despite this, I am neutral on the stock, as I see the potential for a low and another rally. However, investors should know that much of that may be speculative once more and may not allow Aron’s Apes to break even.

[ad_2]

Source link